Marvell Technology Stock:– We will know about Marvell Technology Inc., how many employees are there in this company, what is its market cap volume, on which exchange is it listed and what will be its next growth in the coming 2030 what the price is going to be

Marvell Technology previous close is $76 and market cap is 72.337 billion new shares average volume is 20.66 million and dividend yield is 0.29% and this company is listed on primary exchange NASDAQ

The CEO of Marvell Technology is Mathew Murphy and this company was formed in 1995 and its headquarter is in Wilmington, Delaware United States and the total number of employees in this company is 7042

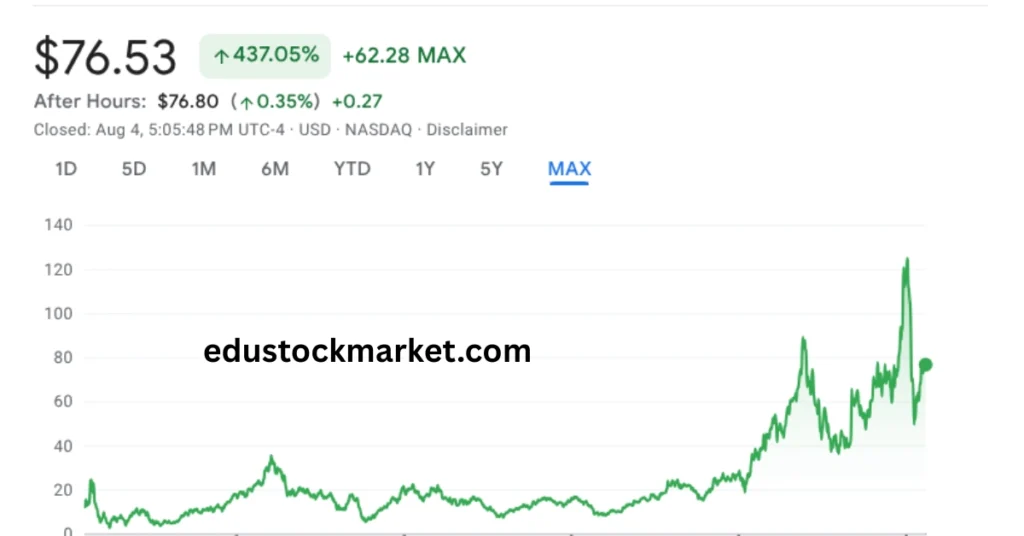

Marvell Technology Stock Price History

Forecasts for 2025–2030

2025

- Average annual trading range expected: $67–$116 coincodex.com

- LongForecast model: ~$87.60 average, high ~$93.43, low ~$79.59 Long Forecast

- Coinpriceforecast.com: year-end projection of $83 (≈42% growth) by mid‑2025 Coin Price Forecast

2030

- StockScan.io: average target ~$116.05 (range: $103.20–$128.90) StockScan

- WalletInvestor: more bullish forecast of $172.16 by mid‑July 2030 walletinvestor.com

Unique Blog‑Style Analysis: “Marvell’s Future: 2025–2030

Introduction: Riding the AI Wave

Since its 2021 pivot into custom silicon and AI-focused datacenter chips, Marvell has positioned itself at the heart of cloud infrastructure expansion. With key partnerships (e.g. Microsoft Maia chips) and a growing addressable market forecast to reach $94 billion by 2028, momentum is building—but headwinds remain.Marvell Technology MarketWatch+2Investopedia+2MarketWatch+2

Risks & Volatility

- 2025 has been rough: stock has fallen ~40–45% YTD, due to weak guidance, investor day delays, and macro pressures. Palmetto GrainMarketWatchBarchart.com

- Mixed growth projections: EPS may shrink by ~17% to $1.30 by 2030 per BTCC model. BTCC

Mid-Term Outlook (by end‑2025)

Moderate targets (~$80–$100) reflect near-term stability:

- Morgan Stanley sees modest upside to $80 Palmetto Grain

- LongForecast expects mid‑80s to low 90s range Long Forecast

Bullish scenarios:

- BofA’s $150 target sees rapid custom AI chip adoption Investopedia

- Jefferies forecasts $120 as a baseline for 2025 growth under AI tailwinds barrons.com

Long-Term Projection (by 2030)

Assuming solid expansion in datacenter and AI infrastructure:

- Averages around $110–$120 are realistic, per StockScan, barring execution missteps. Investopedia+1Investopedia+1

- If Marvell secures more custom client wins and scaling success, WalletInvestor model projects up to $172. walletinvestor.com

Downside scenarios caveated:

- If competitive pressures (e.g. Amazon Trainium, macroeconomics) persist, stock may underperform toward low‑$60s territory. MarketWatch+1Palmetto Grain+1

Summary Table: Price Targets by Time Horizon

| Period | Conservative | Consensus (Avg) | Bullish | Bear Case |

|---|---|---|---|---|

| End of 2025 | ~$80 | ~$90–95 | ~$120–150 | ~$60–70 |

| By 2030 | ~$100 | ~$110–120 | ~$170+ | ~$60 |

Key Drivers to Watch

- AI & cloud customer wins (especially Microsoft, Amazon, Google)

- Revenue guidance & margin recovery—particularly if optics and custom silicon ramp

- Macroeconomic and capex plans of major cloud providers (e.g., shifts in projected data center spend) investors.comInvestopediainvestors.com

- Product execution, cadence of chip rollouts, and any delays or cancellations

Final Take

Wall Street remains broadly optimistic on Marvell: consensus price targets cluster around $90–$100 for the near term, with upside in select bullish scenarios rising toward $150. Looking toward 2030, projections span from $110–$120 on moderate execution, with potential highs beyond $160 if AI infrastructure momentum accelerates. That said, macro slowdowns or competitive losses could push valuation lower.

Bottom line: MRVL is a high-volatility AI‑chip candidate—solid potential upside if execution and cloud demand persist, but not without measurable downside risk.

FAQ:-

1. What does Marvell Technology do?

Answer:

Marvell Technology Inc. is a leading semiconductor company specializing in data infrastructure solutions. It designs and develops chips for cloud computing, AI, 5G networks, and enterprise storage, with a growing focus on custom silicon for hyperscalers like Microsoft and Amazon.

2. Why is Marvell stock considered important for AI growth?

Answer:

Marvell provides custom chips and advanced networking components that power AI workloads in data centers. As AI adoption increases globally, demand for Marvell’s technologies is expected to rise significantly—positioning it as a core beneficiary of the AI boom.

3. What is the price prediction for Marvell stock in 2025?

Answer:

Most analysts forecast Marvell stock to trade between $85–$100 by the end of 2025. Some bullish targets go as high as $120–$150, depending on custom chip adoption and cloud partnership growth.

4. How high could Marvell stock go by 2030?

Answer:

By 2030, Marvell’s stock price could potentially reach $110–$130 on average. In more optimistic forecasts, if AI demand accelerates and Marvell captures greater market share, the stock could climb beyond $160–$170.

5. What are the main risks for MRVL stock?

Answer:

Key risks include:

- Weak guidance or earnings performance

- Delays in AI chip adoption

- Macro factors affecting tech spending

- Strong competition from companies like Nvidia, Broadcom, and AMD

6. Is Marvell stock a good long-term investment?

Answer:

Marvell is considered a strong long-term AI play due to its product pipeline and partnerships. However, it’s a high-volatility stock, so long-term investors should monitor earnings, competition, and broader market conditions carefully.

7. Has Marvell paid dividends?

Answer:

Yes, Marvell does offer a small quarterly dividend. However, it’s primarily viewed as a growth stock, so most of its value lies in potential capital appreciation rather than dividend income.

8. What caused the recent drop in MRVL stock?

Answer:

In early 2025, MRVL stock fell sharply (~40%) due to disappointing guidance, delays in investor events, and investor concerns over AI infrastructure spending slowdowns. Many analysts still believe this is a temporary dip in a long-term growth story.

Conclusion: Marvell Technology Stock Price Prediction (2025–2030)

Marvell Technology (MRVL) stands at the crossroads of two powerful trends—AI acceleration and custom silicon innovation. Its strategic pivot toward cloud data centers, AI infrastructure, and custom chips (like Microsoft’s Maia) positions it as a long-term growth contender in the semiconductor space.

By 2025, most analysts expect MRVL stock to trade between $85 and $100, with bullish cases aiming for $120–$150, assuming strong AI chip demand and cloud partnership expansion. Looking ahead to 2030, projections range from $110–$130, while the most optimistic models estimate it could reach as high as $170+, fueled by broader AI adoption and revenue growth.