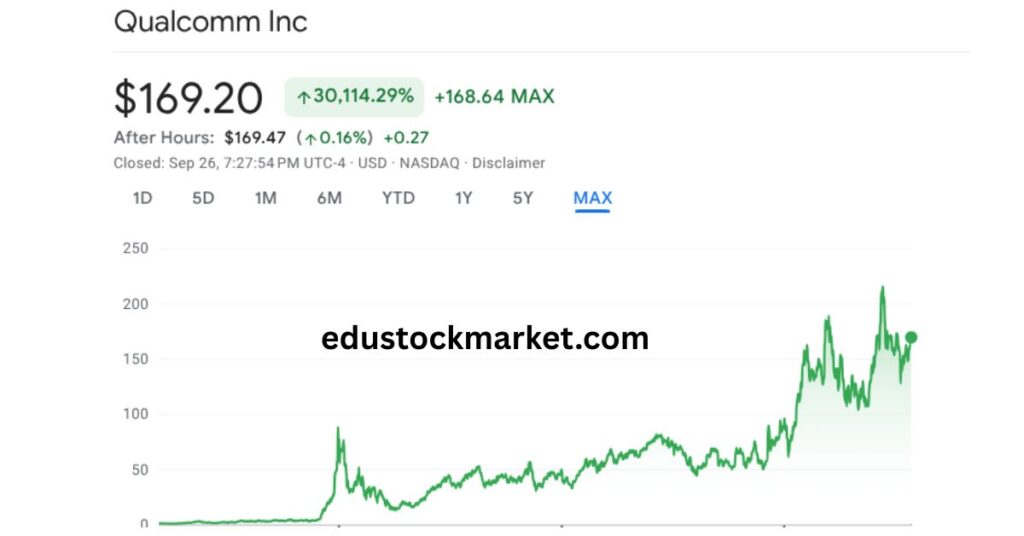

Qualcomm Stock Prediction 2025 to 2035:- Quick take: Qualcomm sits at the crossroads of mobile connectivity, automotive electrification, edge AI, and the broader Internet of Things. If the company executes on chips, licensing, and new growth markets (auto, XR, edge AI), the qualcomm stock price can meaningfully rerate over the next decade. If it stumbles on patents, competition, or geopolitics, the upside will be constrained. Below is a direct, human, and practical view of drivers, risks, and scenario-based price ranges for qualcomm stock price from 2025 through 2035 — plus what investors should watch quarter to quarter.

Why Qualcomm matters today

Qualcomm is more than a smartphone chip supplier. Its business breaks down into two durable pillars: Qualcomm Stock Prediction 2025 to 2035

- Chipsets & platforms — Snapdragon mobile SoCs, modems, RF front-end, and now specialized chips for edge AI and automotive.

- IP licensing & royalties — payments from phone makers and device OEMs for access to Qualcomm’s cellular standards patents.

These two strands give Qualcomm high-margin recurring cash (royalties) and cyclical-but-scalable hardware revenue. The qualcomm stock price reflects both the stability of licensing and the growth potential of its hardware roadmap (5G/6G, AI accelerators, automotive compute).

Key long-term drivers for the Qualcomm stock price

- 5G upgrade cycles and 6G beginnings

- Continued 5G rollouts in developing markets and refreshing phone bases in developed markets keep demand for modems and RF chips healthy. Early 6G R&D and standards involvement offer optionality.

- Edge AI and on-device compute

- On-device AI (phones, XR headsets, smart cameras) requires specialized accelerators. Qualcomm’s success here will expand margins and stickiness.

- Automotive growth

- Automotive telematics, ADAS/automated driving stacks, and infotainment represent a large new TAM if Qualcomm wins design-ins.

- IoT & broadband connectivity

- Billions of connected sensors and devices need low-power wireless chips; this is a long tail of volume but meaningful aggregate sales.

- Licensing & royalty resilience

- Qualcomm’s patent portfolio drives high-margin, recurring revenue. Defending licensing terms globally is essential.

- Foundational partnerships

- OEM relationships (Apple historically an example of licensing wrangles), cloud and auto partners, and fabs can accelerate or slow product roadmaps.

When these factors trend positive, the qualcomm stock price tends to reflect both earnings growth and a higher valuation multiple.

Main risks that could pressure Qualcomm’s stock

- Regulatory / antitrust issues: Licensing scrutiny or unfavorable rulings (anywhere from the U.S. to China or the EU) could hit royalty growth and margins.

- Competitive chip designs: Apple’s in-house SoCs, MediaTek’s value chips, and rivals in RF or AI accelerators threaten market share.

- Geopolitics & export controls: Restrictions on shipping advanced chips to certain regions could limit TAM or force costly redesigns.

- Execution & foundry constraints: If partners Qualcomm Stock Prediction can’t deliver advanced process nodes on time, Qualcomm’s product timelines suffer.

- Cyclical smartphone demand: Macro slowdowns reduce device upgrades, hitting chip sales.

These risks create meaningful downside scenarios for the qualcomm stock price over a multi-year horizon.

Valuation approach and assumptions

I use a blended method: revenue growth driven by hardware momentum + steady licensing cadence, a gradually improving operating margin as higher-margin silicon and services ramp, and a P/E band that expands with visible secular traction (edge AI, auto). For simplicity: Qualcomm Stock Prediction 2025 to 2035

- Base case assumes modest market share gains, stable royalties, and mid-single-digit revenue CAGR from 2025–2035.

- Bull case assumes material wins in automotive and edge AI, lifting revenue growth and multiples.

- Bear case assumes licensing pressure, share losses in key markets, and sluggish smartphone cycles. Qualcomm Stock Prediction

Below are practical scenario ranges — not predictions — to help frame expectations for the qualcomm stock price.

Qualcomm stock price scenarios: 2025 → 2035 (year-end targets)

Format: Year — Bear | Base | Bull (all USD, year-end ranges)

- 2025 — 80–110 | 120–150 | 160–200

- 2026 — 85–115 | 135–165 | 180–230

- 2027 — 90–125 | 150–185 | 200–260

- 2028 — 95–135 | 165–205 | 230–300

- 2029 — 100–145 | 185–230 | 260–340

- 2030 — 105–155 | 200–250 | 300–380

- 2031 — 110–165 | 220–275 | 330–420

- 2032 — 115–175 | 240–300 | 360–460

- 2033 — 120–185 | 260–330 | 400–520

- 2034 — 125–195 | 280–360 | 440–580

- 2035 — 130–205 | 300–400 | 480–650

How to read these: The base path assumes steady execution and modest multiple expansion; the bull path requires clear, sustainable wins in new TAMs (automotive compute, XR platforms, on-device AI) and favorable licensing dynamics; the bear path reflects persistent licensing/legal pressure or major market-share erosion. Qualcomm Stock Prediction 2025 to 2035

What could move the needle — catalysts to watch

- Quarterly revenue mix: acceleration in non-phone segments (automotive, IoT, XR).

- Major design wins: automotive platforms, new flagship smartphone OEMs, or XR headset partnerships. Qualcomm Stock Prediction

- Licensing outcomes: court decisions or settlements that favor Qualcomm’s royalty model.

- New product launches: Snapdragon platforms with markedly better AI performance or dramatically improved power efficiency.

- Macro indicators: replacement cycles for smartphones, capex cycles in telco infrastructure (5G/6G).

- Capital returns: unexpected buybacks or dividend hikes can support the qualcomm stock price in sideways markets. Qualcomm Stock Prediction

Metrics and milestones investors should track each quarter

- Chip ASPs and unit shipments (mobile, auto, IoT)

- Royalty / licensing revenue growth and margins (visibility into recouping R&D)

- Automotive design announcements and revenue recognition

- R&D spend vs. gross margin: are higher investments translating into better silicon?

- Balance sheet & free cash flow: ability to self-fund M&A or returns.

- Geographic revenue mix: exposure to China vs. U.S./Europe (regulatory risk indicator)

Tracking these helps you infer whether the qualcomm stock price is rightly priced for growth or complacency. Qualcomm Stock Prediction 2025 to 2035

Practical investment strategies

- Buy-and-hold for secular exposure: If you believe 5G → 6G, edge AI, and automotive connectivity win out, consider a multi-year hold tied to conviction in Qualcomm’s roadmaps.

- Swing trading on catalysts: Use earnings, design-win announcements, or licensing updates to add/subtract exposure. Qualcomm Stock Prediction

- Hedged exposure: Combine Qualcomm with other semiconductor or communications names to diversify idiosyncratic risk.

- Dividend & income angle: Qualcomm pays a dividend; in turbulent markets that can temper drawdowns while you wait for strategic wins.

Closing thoughts

The qualcomm stock price over 2025–2035 is not a single number — it’s a range driven by product execution, licensing defense, and the company’s ability to win new markets (automotive, XR, edge AI). In the base case, Qualcomm should compound as connectivity and on-device intelligence proliferate; the bull case rewards clear leadership in new compute paradigms; the bear case reflects legal/regulatory or competitive setbacks. Qualcomm Stock Prediction

If you’re an investor, focus less on quarterly noise and more on the structural wins: strong OEM partnerships, consistent licensing outcomes, and demonstrable progress in automotive and AI silicon. Those are the most reliable reasons the qualcomm stock price could move meaningfully higher over the next decade. Qualcomm Stock Prediction

FAQ

- Is Qualcomm a buy for long-term investors? If you believe in 5G/edge AI and Qualcomm’s patents/roadmap, it’s a reasonable core holding — but watch licensing and competition.

- Will Qualcomm pay a dividend? Yes; the company has a history of dividends and share repurchases that support total return. Qualcomm Stock Prediction

- What’s the biggest risk to the stock? Licensing/regulatory rulings and losing OEM design wins in phones or automotive.

Conclusion

Looking at Qualcomm’s future, one thing is certain: it will remain a critical enabler of global connectivity and computing. The company’s two-pillar model — chipsets and licensing — gives it both cyclical upside and steady cash flows. Over the next decade, the qualcomm stock price will depend on how well the company expands beyond smartphones into automotive, edge AI, XR, and IoT while maintaining its licensing strength Qualcomm Stock Prediction