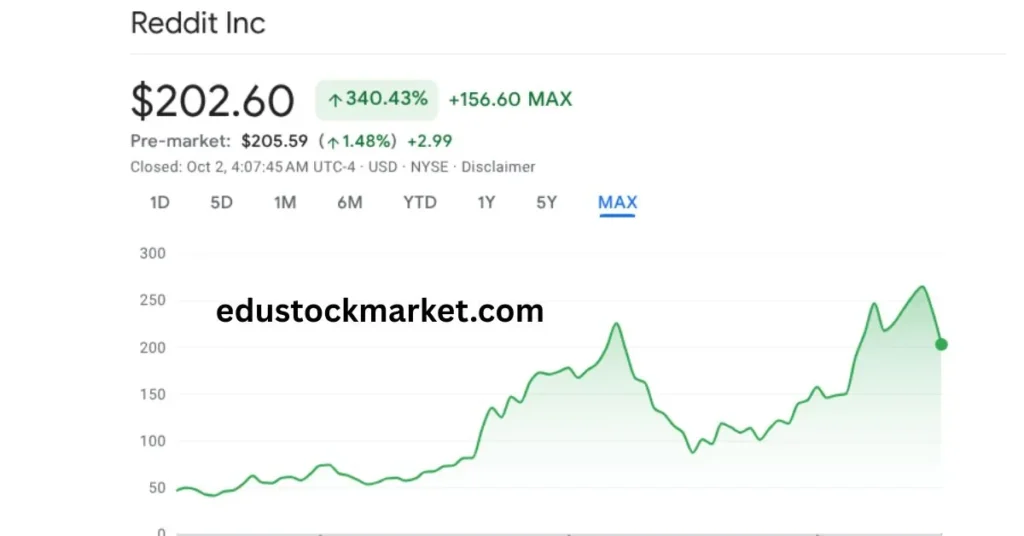

Reddit Stock Price Prediction 2025 to 2040:- Reddit, the social media giant known as “the front page of the internet,” officially went public in March 2024 under the ticker symbol RDDT. With more than 500 million monthly active users, niche communities, and a vibrant discussion-driven ecosystem, Reddit represents a unique player in the social media and digital advertising space. Since its IPO, investors have been eager to understand where the reddit stock price could be headed over the long term.

This article explores Reddit’s business fundamentals, revenue model, competitive position, growth drivers, risks, and most importantly, a year-by-year reddit stock price forecast from 2025 through 2040.

Understanding Reddit’s Business Model

Before diving into forecasts, it’s essential to understand Reddit’s revenue sources:

- Advertising: Primary source of revenue, similar to Meta, Twitter (X), and Snap.

- Premium Subscriptions: Reddit Premium offers ad-free browsing, extra features, and perks for power users.

- Data Licensing: Selling access to Reddit’s vast data for AI model training and analytics.

- Virtual Goods & Awards: Users purchase coins and awards to highlight posts and comments.

These revenue streams provide Reddit with both high-growth potential and volatility, directly impacting the reddit stock price.

Competitive Landscape

Reddit competes with:

- Meta Platforms (Facebook, Instagram) – Dominant ad revenue model.

- X (formerly Twitter) – Similar community-driven discussion platform.

- Snapchat & TikTok – High engagement with younger demographics.

- Discord – Strong community engagement in niche spaces.

What makes Reddit different is its authentic, discussion-first culture, which can be monetized in unique ways if management executes correctly. The reddit stock price will be influenced by whether it can balance monetization with maintaining its community-first ethos.

Key Growth Drivers for Reddit Stock Price

- Advertising Revenue Expansion

- With over 100,000 active communities (subreddits), Reddit has untapped potential for highly targeted advertising.

- AI & Data Licensing

- AI companies like OpenAI and Google have paid Reddit for access to user-generated content. This could become a significant revenue stream.

- Premium & Subscription Growth

- If Reddit Premium gains more traction, recurring revenue will stabilize earnings and support the reddit stock price.

- International Expansion

- Reddit’s user base is heavily concentrated in the U.S., but global expansion offers new opportunities.

- IPO Momentum & Investor Confidence

- Post-IPO, if Reddit demonstrates consistent quarterly growth, institutional investors may support higher valuations.

Risks That Could Impact Reddit Stock Price

- User Backlash to Monetization: Reddit communities resist heavy commercialization. Missteps can reduce engagement.

- Advertising Dependence: Over-reliance on ads could hurt during economic downturns.

- Competition: TikTok, Discord, and Meta may draw users and ad dollars away.

- Content Moderation Issues: Misinformation, hate speech, or political controversies could lead to stricter regulation.

- Profitability Concerns: Like Twitter before Elon Musk, Reddit must prove it can achieve sustained profitability.

These risks create volatility, meaning the reddit stock price could swing dramatically.

Reddit Stock Price Prediction 2025–2040

Below is a scenario-based forecast for the reddit stock price:

Bull Case Scenario

- Strong advertising growth.

- Successful AI licensing deals.

- International expansion and monetization.

- Steady user growth with improved profitability.

Estimated reddit stock price:

- 2025: $70–$85

- 2026: $80–$100

- 2027: $95–$115

- 2028: $110–$135

- 2029: $125–$150

- 2030: $145–$170

- 2035: $200–$250

- 2040: $300–$400

Base Case Scenario

- Moderate ad revenue growth.

- Subscription growth stabilizes earnings.

- Steady but not explosive international expansion.

Estimated reddit stock price:

- 2025: $60–$70

- 2026: $70–$80

- 2027: $80–$95

- 2028: $90–$110

- 2029: $100–$120

- 2030: $115–$140

- 2035: $160–$200

- 2040: $220–$300

Bear Case Scenario

- Sluggish revenue growth, ad competition intensifies.

- User backlash to monetization limits revenue.

- Global regulatory challenges slow expansion.

Estimated reddit stock price:

- 2025: $45–$55

- 2026: $50–$60

- 2027: $55–$65

- 2028: $60–$70

- 2029: $65–$75

- 2030: $70–$85

- 2035: $90–$120

- 2040: $120–$150

Key Catalysts to Watch

- Quarterly Earnings Growth – Is Reddit scaling ad revenue effectively?

- AI Licensing Deals – Partnerships with AI firms could become a major cash cow.

- User Engagement Metrics – Daily active users (DAUs) and time spent per user.

- Monetization of Subreddits – Creative tools for moderators and communities.

- Global Expansion – Penetration into Europe, Asia, and Africa.

Year-by-Year Outlook

- 2025–2027: Early post-IPO years will be volatile. Focus on monetization and profitability. The reddit stock price will reflect investor patience with its strategy.

- 2028–2030: If Reddit executes, it could see significant stock appreciation driven by ad revenue growth and AI licensing.

- 2030–2035: By this stage, Reddit will either be a stable, profitable social media company or lag behind peers. Stock performance will mirror execution in international markets.

- 2035–2040: Long-term potential rests on whether Reddit innovates beyond traditional ads, potentially entering VR/AR communities, creator monetization, or further AI-driven opportunities.

Long-Term Investment Outlook

- Strengths: Huge user base, unique community-driven platform, untapped monetization.

- Weaknesses: Profitability challenges, competition, community resistance.

- Opportunities: AI licensing, premium services, international expansion.

- Threats: Regulation, ad market slowdown, content moderation issues.

For long-term investors, Reddit presents a high-risk, high-reward opportunity. If it scales revenue like Meta did in the early 2010s, the reddit stock price could multiply by 2040. But if execution falters, it may stagnate or decline.

Conclusion

The reddit stock price from 2025 to 2040 is set to be highly volatile as the company transitions from a popular social platform to a publicly traded business with investor expectations.

- In the bull case, Reddit could become a major player in digital advertising and AI licensing, potentially reaching $300–$400 by 2040.

- In the base case, steady growth would put the stock between $220–$300 by 2040.

- In the bear case, execution issues and competition could limit growth, keeping it under $150 by 2040.

Investors must weigh Reddit’s massive user base and unique positioning against its monetization challenges and regulatory risks. If management balances community culture with profitability, the reddit stock price has strong upside over the next 15 years.

FAQs

1. What is the reddit stock price forecast for 2025?

In a base case, the reddit stock price could be around $60–$70 by 2025.

2. Can Reddit become profitable?

Yes, but it requires scaling advertising and subscription revenue while controlling costs.

3. Is Reddit a good long-term investment?

It’s a high-risk, high-reward stock. If it monetizes effectively, Reddit could mirror the growth paths of Meta and Snap.

4. What are the biggest risks to Reddit stock?

User backlash, competition from TikTok and Meta, and regulatory scrutiny.

5. Could Reddit stock reach $300 by 2040?

Yes, in a bull case scenario with strong ad growth, international expansion, and AI licensing deals, the reddit stock price could cross $300