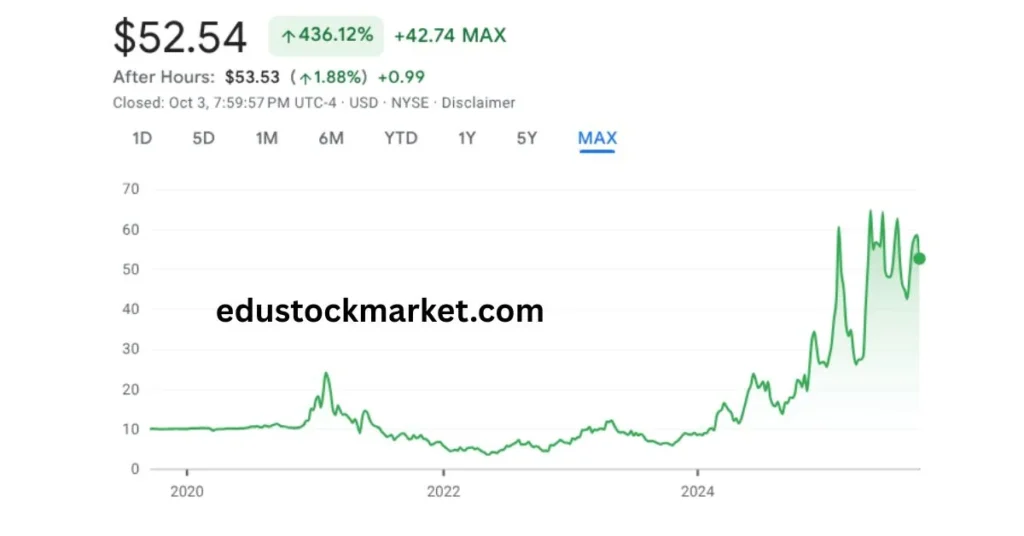

Hims Stock Prediction 2025 to 2040:– Investors in digital health and wellness often eye hims stock as a bold, high-growth play. Founded in 2017, Hims & Hers (ticker HIMS) has built a telehealth platform that offers prescription and over-the-counter care in areas such as dermatology, sexual health, mental health, and wellness. MarketScreener+3Wikipedia+3Simply Wall St+3

But with opportunity comes uncertainty. In this post, I’ll walk through the factors shaping hims stock, then present a year-by-year projection from 2025 through 2040. Treat these as plausible scenarios, not guarantees.

Why Hims Matters: Current Position & Strengths

Before predictions, let’s get grounded in what Hims is doing now and where it stands. Hims Stock

Business model & market position

- Hims operates a direct-to-consumer telehealth platform, combining online consultations, prescriptions, wellness products, and follow-up care. StockStory+3Wikipedia+3StockAnalysis+3

- It has diversified beyond hair loss and sexual health into skin care, mental health, and previously into weight-loss drug offerings (notably compounded versions of semaglutide options). Seeking Alpha+4Wikipedia+4StockAnalysis+4

- In 2025, Hims is expanding internationally—its acquisition of UK-based Zava shows ambition to reach Europe (Germany, France, Ireland) using existing telehealth infrastructure. Reuters+1

Financial & operational metrics

- Recent revenue growth has been strong. For example, Hims is seeing YoY revenue growth rates well above 70–80% in some quarters. StockStory+4Forbes+4Seeking Alpha+4

- Profitability is still modest. Operating margins remain thin relative to large incumbents, though the company is showing improving margin leverage as scale increases. StockAnalysis+3Forbes+3Simply Wall St+3

- It holds a solid balance sheet. Debt is low relative to market cap; Hims has low debt and Hims Stockadequate cash reserves, giving flexibility in investing for growth or weathering downturns. Forbes+2Simply Wall St+2

Key risks & headwinds

- Regulatory & FDA exposure: In 2025, Hims announced it would phase out its compounded versions of GLP-1 weight loss drugs (e.g. Wegovy / Ozempic knockoffs) following regulatory changes. That business had contributed to revenue, and its removal will stress margins. Forbes+3Business Insider+3Investors+3

- Competition & substitution: Big pharma, telehealth incumbents, and generic drug makers are all potential competitors.

- Valuation sensitivity: Hims stock trades at high multiples (e.g. P/E ~70+) based on recent earnings. Seeking Alpha+4StockAnalysis+4MarketScreener+4

- Operational execution: Scaling telehealth in new markets, maintaining quality of care, managing regulatory compliance, and cash burn control are all challenges.

Given this backdrop, let’s move into projections.

Hims Stock Prediction 2025 to 2040: Year-by-Year Forecasts

Below is a projected trajectory for hims stock, broken into phases. These are scenarios assuming reasonable execution, occasional setbacks, and macro cycles. Hims Stock

2025–2027: Stabilization and rebuilding momentum

- 2025 target range: $25 – $45

- After the regulatory hit with the phaseout of compounded GLP-1 offerings, Hims will have a transitional year. The stock will oscillate with quarterly results, investor confidence, and balance sheet moves. Hims Stock

- 2026 target range: $35 – $60

- As the company shifts to more stable core categories (wellness, dermatology, mental health) and adjusts operations, growth may resume with renewed investor trust.

- 2027 target range: $50 – $85

- By now, revenues from diversified categories should dominate over the discontinued drug business. International expansion (via Zava, etc.) may begin to contribute meaningfully.

2028–2032: Scaling & multiple re-rating

- 2028–2029: $80 – $140

- Telehealth adoption in Europe, product extensions (hormonal health, menopause, skin treatment), and recurring revenue strength will drive investor re-rating.

- 2030: $120 – $200

- If Hims can show consistent profitability, global reach, and brand strength, it might begin to be judged more like a healthtech growth enterprise than a venture-stage startup.

- 2031–2032: $160 – $260

- At this stage, Hims may introduce AI-powered health diagnostics, preventive care modules, or subscription health coaching frameworks. Such upgrades can justify premium multiples.

2033–2040: Maturity, platform play, possible plateau

- 2033–2035: $200 – $350

- Hims becomes a recognized platform in digital health across multiple geographies. Monetization from data, teleconsulting, device integrations (wearables, diagnostics) may add new lines of revenue.

- 2036–2040: $250 – $450+

- Growth may slow but stability and recurring revenue strength help. If the company innovates well (e.g. health AI, diagnostics, remote monitoring), upside beyond these ranges is possible.

Here’s a simplified table:

| Period | Hims Stock Prediction |

|---|---|

| 2025 | $25 – $45 |

| 2026 | $35 – $60 |

| 2027 | $50 – $85 |

| 2028–2029 | $80 – $140 |

| 2030 | $120 – $200 |

| 2031–2032 | $160 – $260 |

| 2033–2035 | $200 – $350 |

| 2036–2040 | $250 – $450+ |

Drivers That Could Push or Pull Hims Stock

Let’s talk about levers and risks that will influence how close (or far) hims stock lands relative to these forecasts.

Upside drivers

- Successful international expansion

Acquisitions like Zava and efficient entry into European markets can unlock new customer bases. Seeking Alpha+3Reuters+3Investopedia+3 - Product innovation / vertical expansion

Moving further into hormonal health, preventive care, diagnostics, subscription models, and perhaps hardware or wearable integration. - Improving unit economics & margins

As scale comes, fixed costs dilute and recurring revenue becomes a greater share. - Reg tech & compliance mastery

Staying ahead in regulation can reduce risk and grant a competitive moat. - Health tech partnerships & licensing

If Hims can license its telehealth platform, data models, or wellness technology, that could open non-linear revenue.

Downside / drag risks

- Regulatory reversals (FDA scrutiny, telemedicine rules)

- Negative press or compliance failures

- Slower uptake in Europe or tougher competition

- Temporary margin compressions, cash burn

- Market sentiment shift: high-growth stocks are more vulnerable in downturns

Reasonableness & Sensitivity: How Far Off Could We Be?

This is a high-volatility forecast. The farther you project, the greater the uncertainty. The ranges I set above assume moderate success; if Hims severely underperforms or faces regulatory blocks, the stock might retreat to much lower levels than the lower bounds shown.

Conversely, under best-case breakthroughs (e.g. breakthrough health AI platform, global dominance), hims stock could exceed the upper bands by multiples, reaching even $500+ by 2040 in the most bullish scenario.

Conclusion

Hims stock is a long-view bet on telehealth, wellness, and digital care evolution. The years ahead (2025–2027) are reparative: navigating regulatory changes, phasing out unstable revenue lines, and refocusing on core services. But from 2028 to 2035, if Hims executes well, it may transform into a multi-vertical health platform with strong recurring revenue—and investor re-rating could follow.

My projections put hims stock near $25–$45 in 2025, rising toward $200+ by 2030, and potentially reaching $250–$450+ by 2040 in base scenarios. But it’s not linear—not every year will show smooth growth, and dips are likely.

If you’re considering investing, treat Hims as a high-risk, high-reward play. Keep an eye on regulatory updates, quarterly margin trends, and international execution. And always diversify: no single stock goes straight upward forever.