American Battery Technology Stock Prediction 2025 to 2040:- The electric vehicle (EV) revolution is reshaping global markets, and battery technology companies are at the core of this transformation. Among the key players, American Battery Technology stock has gained increasing attention from retail and institutional investors alike. With its unique positioning in lithium-ion battery recycling, resource extraction, and advanced manufacturing, the company represents both a growth opportunity and a long-term sustainability play.

In this blog, we will take a deep dive into American Battery Technology stock prediction from 2025 to 2040, covering company fundamentals, industry trends, valuation outlook, and possible risks and rewards.

Understanding American Battery Technology Company

Before diving into stock projections, it’s important to understand the business model. American Battery Technology Company (ABTC) operates in three major segments:

- Battery Recycling: Recovering critical minerals like lithium, cobalt, and nickel from used batteries.

- Primary Resource Development: Extracting minerals directly from natural resources.

- Battery Manufacturing: Using recovered materials to create new high-performance batteries.

This closed-loop supply chain strategy positions American Battery Technology as a sustainable leader in a sector where demand for lithium-ion batteries is expected to skyrocket.

Key Drivers for American Battery Technology Stock

- EV Adoption Boom

With automakers like Tesla, Ford, GM, and global giants such as Toyota investing heavily in EVs, demand for batteries is projected to grow exponentially. - Government Support

The U.S. government and international regulators are pushing for localized, sustainable supply chains. Incentives for battery recycling and manufacturing provide a tailwind for ABTC. - Sustainability Edge

Unlike many competitors, American Battery Technology stock benefits from its eco-friendly approach, tapping into the rising investor demand for ESG-focused companies. - Lithium Supply Chain Leadership

Lithium prices are volatile, but demand is undeniable. If ABTC can scale efficiently, it could emerge as a major domestic lithium supplier in the U.S. - Innovation and Technology

The company’s patented technologies in recycling and refining processes could provide it with a competitive advantage in cost and efficiency.

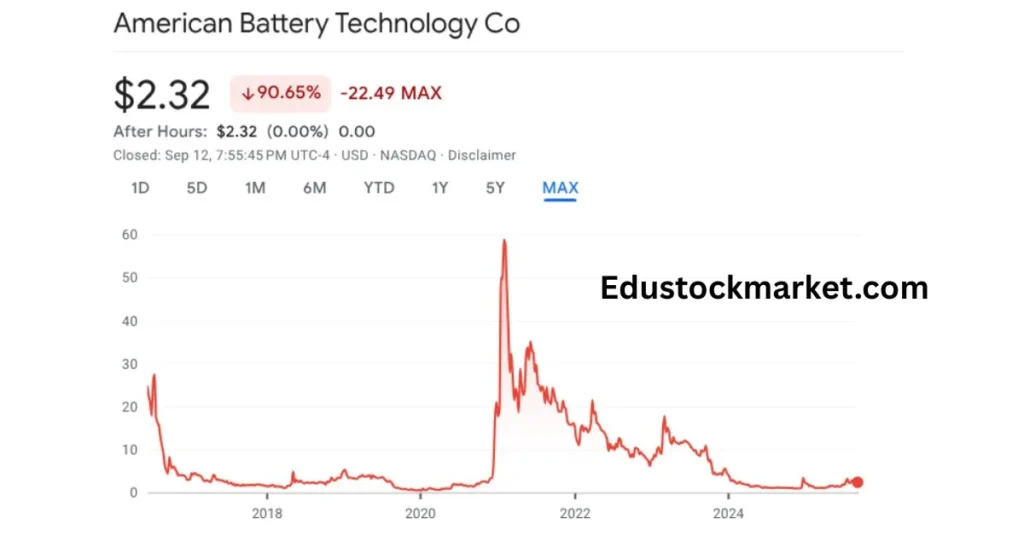

American Battery Technology Stock Price Prediction (2025–2040)

Now, let’s break down projections year by year (short term) and then decade by decade (long term). These are speculative but based on industry growth forecasts, market trends, and ABTC’s potential.

American Battery Technology Stock Prediction 2025

By 2025, American Battery Technology is expected to be in its growth phase, scaling recycling operations and signing contracts with EV manufacturers.

- Conservative Estimate: $8 – $12

- Optimistic Estimate: $15 – $20

If ABTC delivers on its expansion roadmap, 2025 could mark its shift from a speculative penny stock into a mid-cap growth stock.

American Battery Technology Stock Prediction 2030

By 2030, EV adoption is projected to dominate new car sales globally. Recycling demand will be massive as first-generation EV batteries reach end-of-life.

- Conservative Estimate: $25 – $35

- Optimistic Estimate: $40 – $55

This growth would reflect ABTC’s expansion into large-scale recycling facilities and partnerships with automakers.

American Battery Technology Stock Prediction 2035

By 2035, EVs could account for 70%+ of all new vehicle sales worldwide. Lithium and other minerals will be critical, and recycling will be a trillion-dollar industry.

- Conservative Estimate: $60 – $80

- Optimistic Estimate: $90 – $120

At this stage, ABTC could emerge as a global leader in sustainable battery materials, potentially rivaling giants in the industry.

American Battery Technology Stock Prediction 2040

Looking 15 years ahead is challenging, but if ABTC remains competitive and scales operations globally, it could become a blue-chip stock.

- Conservative Estimate: $130 – $160

- Optimistic Estimate: $180 – $220

By 2040, American Battery Technology stock could benefit from:

- Widespread EV adoption (90%+ market share).

- Increased reliance on recycled battery materials.

- Strong ESG-driven institutional investment.

Factors Supporting Long-Term Growth

- EV Growth Curve

With global governments banning combustion engines (EU by 2035, California by 2035), demand for batteries will keep accelerating. - Recycling Mandates

Regulatory pressure will require automakers to recycle old EV batteries, fueling ABTC’s core business. - Strategic Partnerships

Contracts with carmakers and energy companies could secure steady revenue streams. - Lithium Independence in the U.S.

America’s reliance on foreign lithium could decrease if ABTC scales its domestic mining and recycling operations.

Risks That Could Impact American Battery Technology Stock

- Execution Risk

If ABTC fails to scale operations or faces technological bottlenecks, growth could stall. - Competition

Giants like Tesla, Panasonic, and CATL could expand their own recycling and supply chains, challenging ABTC’s dominance. - Commodity Price Volatility

Lithium, nickel, and cobalt prices are highly cyclical. Price crashes could hurt revenues. - Regulatory Challenges

Strict environmental laws or unforeseen policy changes could increase operational costs. - Profitability Concerns

As of now, ABTC is not consistently profitable. Investors must be prepared for volatility until it stabilizes.

Summary Table: American Battery Technology Stock Predictions

| Year | Conservative Target | Optimistic Target |

|---|---|---|

| 2025 | $8 – $12 | $15 – $20 |

| 2030 | $25 – $35 | $40 – $55 |

| 2035 | $60 – $80 | $90 – $120 |

| 2040 | $130 – $160 | $180 – $220 |

Should You Invest in American Battery Technology Stock?

The future of american battery technology stock depends on its ability to:

- Scale operations profitably.

- Maintain leadership in recycling technology.

- Secure long-term partnerships.

For risk-tolerant investors, ABTC could be a multi-bagger growth story in the making. For conservative investors, it may still feel too early, as volatility will likely remain high for years.

Conclusion

The american battery technology stock prediction 2025 to 2040 highlights both exciting opportunities and inherent risks. With the EV revolution gaining momentum, ABTC is well-positioned in a sector that will define the future of transportation and energy storage.

If ABTC successfully scales its operations, innovates in recycling, and builds strong industry ties, it could transform into a sustainability-driven powerhouse by 2040. However, investors should remain cautious, diversify portfolios, and prepare for short-term volatility.

In short: High risk, potentially high reward.

Trending FAQs About American Battery Technology Stock

Q1. What does American Battery Technology Company do?

ABTC focuses on battery recycling, resource extraction, and lithium-ion battery manufacturing.

Q2. Is American Battery Technology stock a good investment for 2025?

It’s speculative but promising. If the company scales successfully, 2025 could mark the start of its growth trajectory.

Q3. What is the stock prediction for American Battery Technology by 2030?

Analysts estimate it could reach between $25 and $55, depending on market and company performance.

Q4. Can ABTC become profitable?

Yes, but profitability depends on scaling, cost efficiency, and demand growth in the EV sector.

Q5. What is the long-term potential of American Battery Technology stock by 2040?

If successful, it could trade between $130 and $220, positioning it as a leader in sustainable battery materials.

Q6. What risks should investors watch out for?

Execution risk, competition from larger companies, and commodity price volatility are the main risks.