Figma, a cloud-based collaborative design platform, has rapidly become one of the most influential tools in the design and product development world. Its real-time collaboration features, ease of use, and growing ecosystem have made it a favorite among designers, developers, and enterprises. With the company’s IPO making headlines and attracting investor attention, one of the most asked questions is: What will happen to the figma stock price between 2025 and 2035?

This article explores Figma’s business potential, competitive landscape, growth drivers, and risks to provide a detailed outlook on the figma stock price over the next decade.

Understanding Figma’s Current Position

Before projecting forward, it’s important to establish where Figma stands today.

- Industry: Cloud design, SaaS, and collaboration tools

- Competition: Adobe, Canva, Sketch, and emerging AI design platforms

- Revenue Model: Subscription-based SaaS model with free-to-paid conversions

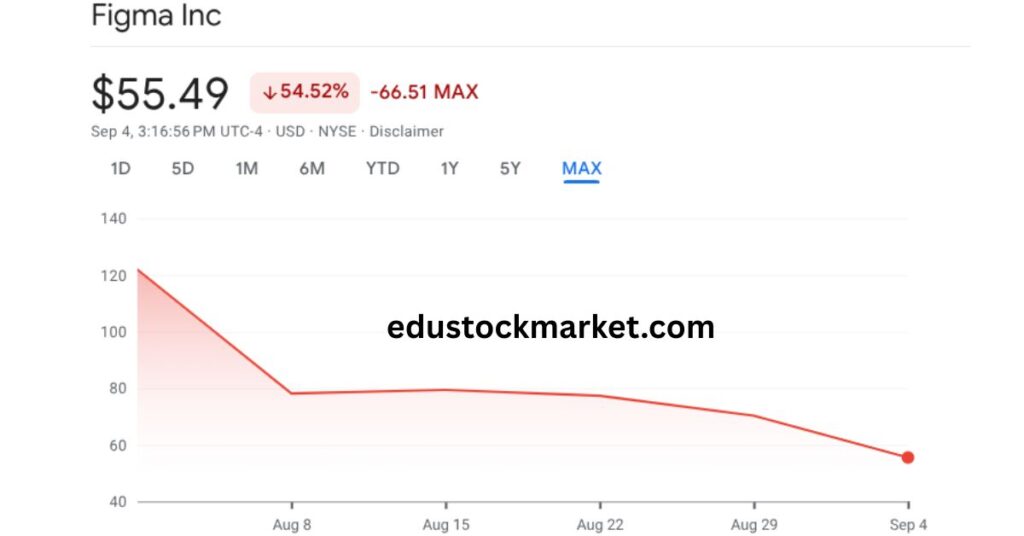

- IPO Status: Recently listed in the U.S. market, with high investor interest

Figma has positioned itself as more than just a design tool. It has evolved into a collaborative hub where design, engineering, and marketing teams can work seamlessly. This foundation gives long-term potential to the figma stock price.

Factors Influencing Figma Stock Price

The figma stock price will be shaped by several critical factors in the next decade:

1. Market Growth in SaaS and Design Tools

The global design and collaboration software market is projected to grow significantly as digital-first businesses expand. Figma, being a pioneer in cloud design, is well-placed to capture market share.

2. Adoption by Enterprises

Figma is increasingly being adopted by Fortune 500 companies. As more corporations move away from desktop-based tools like Adobe XD or Sketch, the figma stock price could rise on enterprise-level revenue growth.

3. Competition with Adobe and Others

Competition remains one of the biggest external factors. Adobe attempted to acquire Figma in 2022 for $20 billion, but regulatory issues halted the deal. The fact that Adobe wanted to buy Figma shows its competitive threat. Investors must keep an eye on how Figma navigates this rivalry.

4. Innovation in AI and Automation

AI is changing the future of design. If Figma integrates generative AI features successfully, it could gain a massive edge over competitors, boosting both revenue and the figma stock price.

5. Global Expansion

Currently, Figma is widely used in the U.S. and Europe, but further penetration into Asia-Pacific, Latin America, and emerging markets will drive its long-term growth.

Figma Stock Price Prediction 2025 to 2035

Below is a year-by-year projection of the figma stock price based on market adoption, revenue potential, and technological advancements.

Figma Stock Price Prediction 2025

- Prediction Range: $60 – $75

- Figma’s IPO momentum will still be fresh. If revenue growth continues above 30% annually, the figma stock price should remain strong.

Figma Stock Price Prediction 2026

- Prediction Range: $70 – $85

- Increased enterprise adoption and global expansion will likely push the stock upward. Investors will watch closely if Figma can show profitability.

Figma Stock Price Prediction 2027

- Prediction Range: $80 – $100

- By this time, Figma could launch new AI-driven features, attracting more enterprise clients. The stock should reflect higher demand.

Figma Stock Price Prediction 2028

- Prediction Range: $95 – $115

- Figma’s recurring revenue model will be more established, and the figma stock price could break past $100 if margins improve.

Figma Stock Price Prediction 2029

- Prediction Range: $110 – $130

- Global presence will expand, and partnerships with other SaaS platforms may help Figma become a default choice for collaborative design.

Figma Stock Price Prediction 2030

- Prediction Range: $125 – $145

- If Figma maintains growth while fending off Adobe and Canva, it could establish itself as a top SaaS design leader. The figma stock price will reflect that dominance.

Figma Stock Price Prediction 2031

- Prediction Range: $135 – $160

- By now, AI-driven design tools may be commonplace, and Figma’s integration strategy will be crucial for keeping its leadership intact.

Figma Stock Price Prediction 2032

- Prediction Range: $150 – $175

- Stronger enterprise contracts and potential government adoption in digital transformation could fuel additional stock growth.

Figma Stock Price Prediction 2033

- Prediction Range: $165 – $190

- Figma could potentially hit profitability milestones comparable to Adobe’s earlier years, giving investors long-term confidence in the figma stock price.

Figma Stock Price Prediction 2034

- Prediction Range: $180 – $210

- By now, the SaaS design industry may consolidate. Figma could either acquire smaller players or expand into areas like 3D design and virtual collaboration.

Figma Stock Price Prediction 2035

- Prediction Range: $200 – $230

- With a decade of growth, Figma could emerge as a global SaaS leader alongside Adobe, Canva, and Microsoft. The figma stock price could reflect a mature, stable, and profitable enterprise.

Risks to Figma’s Growth

While the outlook for the figma stock price is optimistic, several risks must be considered:

- Competition: Adobe and other emerging AI design platforms could take market share.

- Valuation Risk: Like many SaaS IPOs, Figma may face overvaluation concerns.

- Regulatory Challenges: Data privacy and AI regulation could impact operations.

- Profitability Pressure: High R&D and marketing spend may delay consistent net profits.

Why Figma Could Be a Long-Term Winner

Despite risks, there are strong reasons to believe Figma can succeed:

- It has first-mover advantage in collaborative, cloud-based design.

- The brand enjoys community-driven adoption—students, freelancers, and enterprises alike use it.

- Figma has the potential to integrate AI and expand into new digital collaboration verticals.

If these strengths are executed properly, the figma stock price could deliver excellent long-term returns.

Key Takeaways for Investors

- Figma is a strong SaaS growth story, well-positioned in the design industry.

- The figma stock price is likely to show steady upward momentum from 2025 to 2035.

- Short-term volatility may occur due to competition or valuation swings, but the long-term growth story remains intact.

- Investors should monitor profitability milestones and adoption of AI-driven features as key stock drivers.

FAQ

Q1: What is the figma stock price prediction for 2025?

A: Analysts expect the figma stock price to be between $60 and $75 in 2025, driven by IPO momentum and strong SaaS adoption.

Q2: Could Figma’s stock price reach $200 by 2035?

A: Yes. Based on projected adoption, AI integration, and enterprise contracts, the figma stock price could range from $200 to $230 by 2035.

Q3: Is Figma a direct competitor to Adobe?

A: Absolutely. Adobe even attempted to acquire Figma, signaling that it sees Figma as a serious threat. Both companies now compete head-to-head in design software.

Q4: What are the biggest risks to Figma’s growth?

A: Competition, profitability delays, and regulatory hurdles around data and AI are the primary risks that could impact the figma stock price.

Q5: Is Figma stock a good long-term investment?

A: For long-term investors who believe in SaaS adoption and design software growth, Figma has strong potential. However, investors should monitor competition and market conditions.

Conclusion:-

The decade ahead looks promising for Figma. Its innovation in cloud-based design and collaboration has already reshaped the industry, and its IPO has created a wave of excitement among investors.

The figma stock price is expected to rise steadily between 2025 and 2035, with a projection that it could move from around $60 in 2025 to over $200 by 2035. With strong adoption, enterprise contracts, and AI integration, Figma has the potential to be a global SaaS leader.

For investors seeking long-term growth opportunities in the technology and SaaS sector, Figma’s journey could be one worth watching closely.