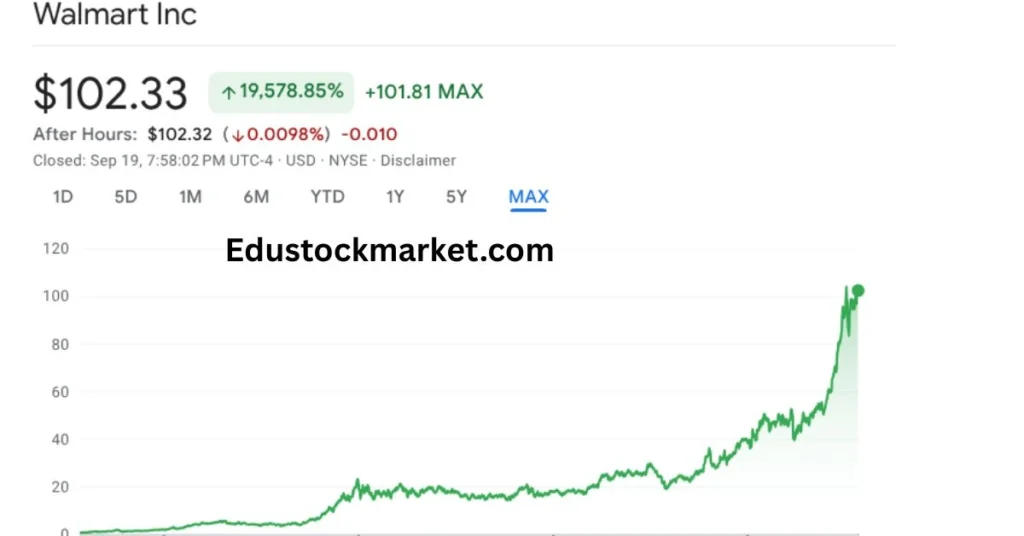

Walmart Stock Price Prediction 2025 to 2035:- Walmart is no longer just a brick-and-mortar grocery giant — it’s a technology-powered retail platform investing heavily in e-commerce, logistics, memberships (Sam’s Club), and AI. That combination makes the walmart stock price a defensive, income-generating holding with an upside tied to execution on digital initiatives. Below I’ll lay out the drivers, risks, and realistic price ranges from 2025 through 2035 so you can judge where Walmart fits in your portfolio.

Why Walmart still matters for investors

Walmart (NYSE: WMT) is the largest retailer in the world by revenue. Over the last few years the company has steadily converted its massive physical footprint into a competitive advantage for e-commerce (store-fulfilled delivery, curbside, same-day) while preserving the low-price, high-turn model that attracts everyday shoppers. As a result, the walmart stock price is being driven by both (a) steady retail fundamentals and (b) growth from tech and logistics investments. Recent earnings and strategic updates show the company pushing both levers. Walmart Corporate News and Information+1

What moves the Walmart stock price (the core drivers)

- Same-store sales and traffic — the retail baseline. If shoppers keep coming and basket sizes hold, revenues remain resilient.

- E-commerce & fulfillment — faster delivery and store-fulfillment lower last-mile costs and protect margins. Walmart’s improvements here are a direct input into future earnings. PYMNTS.com Walmart Stock Price

- Sam’s Club and membership economics — higher member spending and club-fulfilled e-commerce are meaningful profit drivers. Walmart Corporate News and Information

- Pricing power & inflation — Walmart’s scale gives it leverage to absorb or lead price changes without losing customers.

- AI and productivity gains — investments in agentic AI (internal assistants, personalization, supply-chain automation) could lift margins materially if executed well. Analysts are already flagging Walmart as a leader here. Barron’s

- Macro & consumer behavior — recession, unemployment, or big drops in consumer spending will pressure discretionary categories; groceries and essentials cushion the blow.

- Dividends and capital returns — Walmart is a dividend payer with share-repurchase programs that set a valuation floor.

Recent context (why 2025 matters)

Walmart’s FY-2025 performance and early FY-2026 commentary show accelerating e-commerce (notably grocery and Sam’s Club), a slight upward revision to sales guidance, and clear pushes into AI within operations and the app experience. Management raised full-year sales growth guidance in 2025 and highlighted Sam’s Club e-commerce growth and club-fulfilled delivery gains. Those operational trends are already affecting sentiment and the walmart stock price. Walmart Corporate News and Information+1 Walmart Stock Price

Analysts are largely bullish: several large brokerages reaffirm “buy” ratings and have raised price targets as Walmart’s AI road map (and partnerships with Microsoft/OpenAI) became clearer. Market activity in 2025 has pushed the share price to new highs around the low-$100s (intraday highs above $104 in mid-September), showing investor appetite for the story. Barron’s+1 Walmart Stock Price

Valuation framework — how I build price targets

I use a three-pillar approach:

- Top-line growth — sales growth coming from store resilience + e-commerce expansion + Sam’s Club membership upside.

- Margin trajectory — modest margin improvement driven by AI and automation, offset by price promotions during retail competition.

- Capital returns — dividends plus buybacks that set a valuation floor and return cash to shareholders.

I consider three scenarios — Bear (slower execution, margin pressure), Base (steady execution + modest margin gains), and Bull (accelerated AI benefits + faster membership and e-commerce monetization). For each scenario I anchor to a fair P/E band (low single digits for bear, mid teens for base, high teens for bull) that reflects Walmart’s status as a large, low-growth/low-risk retailer.

Walmart stock price prediction: 2025–2035 (year-end targets)

Note: these are year-end target ranges in USD under three scenarios (Bear / Base / Bull). They are probabilistic—not promises.

| Year | Bear | Base | Bull |

|---|---|---|---|

| 2025 | 85–95 | 100–110 | 115–125 |

| 2026 | 80–95 | 105–120 | 125–140 |

| 2027 | 85–100 | 115–130 | 140–160 |

| 2028 | 85–105 | 120–140 | 150–175 |

| 2029 | 90–110 | 125–150 | 160–190 |

| 2030 | 95–115 | 130–160 | 170–200 |

| 2031 | 95–120 | 135–170 | 180–210 |

| 2032 | 100–125 | 140–180 | 190–230 |

| 2033 | 105–130 | 145–190 | 200–245 |

| 2034 | 110–135 | 150–200 | 210–260 |

| 2035 | 115–140 | 155–210 | 220–280 |

How to read this table

- The Bear case assumes slower e-commerce adoption, intensifying margin pressure from price wars, or macro weakness pushing consumers to trade down.

- The Base case assumes Walmart keeps gaining e-commerce share, Sam’s Club scales, AI delivers measurable productivity gains, and margins slowly improve.

- The Bull case assumes Walmart’s AI and execution create step-change efficiency and revenue expansion (new monetization, ad revenue, payment products), lifting multiples.

What could push Walmart into the bull case?

- Meaningful AI productivity gains: If Sparky and other tools automate complex tasks (pricing, assortment, forecasting) and cut operating costs materially, margin expansion would surprise investors. Analysts have recently highlighted Walmart’s potential in “agentic” AI as a true differentiator. Barron’s

- Faster e-commerce monetization: Growth in grocery e-commerce, marketplace fees, advertising, and financial products (co-brand cards, BNPL) could increase revenue per customer. PYMNTS.com

- Sam’s Club acceleration: Membership growth and club-fulfilled e-commerce scaling could add higher-margin recurring revenue. Walmart Corporate News and Information

- Share buybacks & dividend growth: Aggressive capital return programs would support a higher valuation multiple.

Risks that could cap the walmart stock price

- Retail price wars: If competitors force Walmart into persistent discounting, margins could be squeezed.

- Execution failure on AI: Technology is not a guaranteed margin lever — poor implementation or wasted investment would weigh on profits.

- Supply chain / tariff shocks: Higher input costs or trade disruptions can compress gross margins.

- Macroeconomic slowdown: A significant recession could cut discretionary spending and reduce traffic despite Walmart’s defensive positioning.

- Regulatory & antitrust scrutiny: As Walmart expands into financial services and data monetization, regulatory attention could increase.

Practical strategy — what investors should do

- Income investors: Walmart is a reliable dividend payer. Consider a core holding for yield and defensive stability while watching growth catalysts.

- Growth-seeking investors: If you want upside, watch for proof points: consistent Sam’s Club membership growth, sustained e-commerce revenue growth, and early margin lift from AI. Accumulate on weakness once those trends are visible.

- Traders: Near-term volatility will come from earnings beats/misses and macro headlines. Use those windows for tactical entries but avoid overtrading a slow-growing mega cap.

Key metrics and milestones to watch each quarter

- Same-store sales (U.S. comp growth) — the retail heartbeat.

- E-commerce growth (particularly grocery & Sam’s Club) — measure of digital traction. PYMNTS.com

- Operating margin & gross margin trends — to spot efficiency gains or cost pressures.

- Membership metrics for Sam’s Club — ARPU and renewal rates. Walmart Corporate News and Information

- AI & tech announcements — new capabilities, partnerships (e.g., Microsoft/OpenAI) and early ROI metrics. Barron’s

- Capital returns — dividend increases or large buyback programs.

Bottom line — is Walmart a buy for 2025–2035?

If you want a defensive retail position with upside from meaningful tech and membership playbooks, Walmart is a compelling choice. The walmart stock price is unlikely to rocket like a small-cap growth story, but it offers steady cash flows, dividends, and a credible path to margin improvement via AI and logistics. In my Base Case, Walmart steadily compounds shareholder value and trades in the low-to-mid-hundreds by the early 2030s — driven more by sustained execution than by hype. Short-term noise will happen, but the long-term thesis remains rooted in scale, technology, and everyday consumer demand. Walmart Corporate News and Information+1

FAQ

Q: What’s the current walmart stock price range?

A: In 2025, Walmart’s share price has traded around the low-$100s, with intraday highs recently above $104 as investors digest earnings and AI momentum. MarketBeat+1

Q: Will Walmart benefit from AI?

A: Yes — management is embedding agentic AI across commerce, supply chain, and store operations; early analyst commentary is positive about the potential impact. Barron’s

Q: Is Walmart better than Amazon for long-term investors?

A: They’re different. Walmart offers resilience, dividends, and physical/logistics scale. Amazon is higher growth but more valuation-sensitive. Both can coexist in a diversified portfolio. Walmart Stock Price

Q: What’s the most important metric to watch?

A: E-commerce growth tied to store-fulfillment efficiency (delivery speed, cost per order) — this shows whether Walmart’s physical network is earning its keep Walmart Stock Price